Features

Agronomy

Cereals

Economics of intensifying canola rotations

Although the conventional recommendation for canola rotations is to grow canola no more than once in four years, many growers are shortening their rotations to try to take advantage of higher canola prices

November 7, 2008 By Carolyn King

A shorter canola rotation may offer economic benefits in the short term.

|

|

| Wild mustard, with its burgundy pods (top) became a serious problem in some of the continuous Westar plots, while wild mustard was not a problem with the Invigor plots (bottom). |

Although the conventional recommendation for canola rotations is to grow canola no more than once in four years, many growers are shortening their rotations to try to take advantage of higher canola prices. Results from an Agriculture and Agri-Food Canada study show that a three-year rotation can be a good option from an economic perspective, in the short run.

The once-in-four-years recommendation came out of past research showing that longer canola rotations have fewer problems with diseases like blackleg and other crop pests. But how is that recommendation affected by recent developments like hybrid canola cultivars with herbicide tolerance and better blackleg resistance?

To answer that question, researchers Randy Kutcher, Stewart Brandt and Elwin Smith carried out a long-term study at Scott and Melfort, Saskatchewan. They looked at the impacts on yield, disease and economics of the following rotations: continuous canola; canola-wheat; canola-wheat-field pea; canola-wheat-field pea-wheat; and canola-wheat-flax-wheat. For the canola year in each rotation, they compared a herbicide-resistant canola hybrid with good blackleg resistance (Invigor) and a blackleg-susceptible, non-herbicide-resistant variety (Westar), with or without fungicide.

Smith, a bio-economist, determined the net returns from canola in the various rotations using 2007 costs and a five-year average canola price of $318/tonne. The most profitable rotation was the same using the higher 2008 canola price. Not surprisingly, the net returns for Invigor were better than for Westar. Disease and weed problems contributed to Westar’s poorer performance. For instance, the continuous Westar plots eventually developed some serious problems with wild mustard, whereas it was not an issue in the continuous Invigor plots. For Westar, net returns from canola were highest in the four-year rotations.

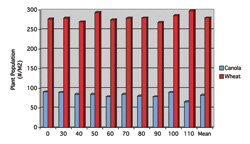

Continuous canola had the poorest net returns for both Westar and Invigor. Brandt, a soil and crop management research scientist, explains that even for the blackleg-resistant hybrid, the incidence and severity of blackleg increased as the rotation became shorter. He adds, “We sometimes also got a lot of volunteer canola plants in the continuous canola, so plant density was higher than desirable and that may have reduced yield as well.”

For Invigor, net returns from canola in the three-year rotation were similar to those for the four-year rotations at Scott, and slightly higher at Melfort, even though a higher incidence of blackleg was seen at Melfort. In the three-year rotation, canola yields benefited when they followed peas. “The higher canola yield is probably due to a nitrogen benefit from growing the nitrogen-fixing field pea crop. In addition, peas often will not extract as much water from the soil as crops like canola or wheat, so there may be a small moisture benefit in some years as well, and that would be particularly true at locations like Scott where moisture is more limiting than at Melfort,” says Brandt.

In this study, fungicide applications to control blackleg did not provide an economic advantage, but that may be due to the study design. Smith explains, “In the study, fungicide treatments had fungicide applied every year, and that strategy wasn’t profitable. Fungicide application is more likely to be beneficial and profitable if applied only when the conditions are right for disease to develop.”

|

| The long-term canola rotation plots at Scott, Saskatchewan. Photos courtesy of Stewart Brandt, Agriculture and Agri-Food Canada. |

Shorter but not too short

In economic terms, the results show that a grower can shorten his canola rotation but not by too many years and not for too many rotation cycles. “Canola after canola is not a recommended option from a profitability standpoint,” says Smith. And growers should also beware of falling profits in two-year rotations. Brandt notes, “Initially we didn’t see much impact on yields of shortening up the rotations, except in continuous canola. But after five or six years, the two year rotation started to separate out as being somewhat lower yielding than the four-year rotation. Growers who shorten up their rotations may be deceived into thinking that there is no penalty, unless they have some land in more appropriate rotations for comparison.”

But the recent developments in canola varieties do give producers some flexibility beyond the once-in-four-years recommendation. Smith says, “From an economics perspective, the benefit of shortening the rotation is much higher when you have high canola prices compared to, say, wheat, and we’ve had a number of years like that lately. So in the short term, producers could grow canola once in three years, and then when wheat or some other crop is more profitable, they could to move back to a longer interval between canola crops to try to prevent disease buildup. That would give them the opportunity to switch back into more canola when prices become more favourable to canola again.”

Brandt agrees, “If you follow a diversified crop rotation with well-adapted crops over the longer term, as a reward you may be able to shorten that up occasionally to take advantage of economic conditions or deal with other problems.”