News

Harvest decisions

New economies, lease options warrant re-assessment of costs and risks associated with combine ownership.

November 23, 2007 By Top Crop Manager

Recent months have challenged even the most seasoned agricultural producer to make financial decisions to leverage the current high commodity prices against current and future production costs. Prudent growers will be focussed on controlling fixed costs wherever possible, while minimizing the impact of variable costs.

The cyclical nature of agriculture demands highly disciplined stewardship of cash flow, opportunity costs and operational balance sheets. Managing short-term profit can enable the grower more latitude in decisions that will increase his productivity and efficient use of capital. Reducing fixed costs can be one of the most effective ways to increase profitability.

Heavy dependence upon machinery ownership exposes producers to a significant level of financial burden and operational risk given the commitment of time and money toward opportunity costs, repair and maintenance. Rising land costs, unprecedented cash rents, escalating input costs and interest rate fluctuations force a closer examination of fixed operating costs and their impact on the profitability of the farm. This environment has created the absolute necessity of more efficient asset management and functional agility.

Liberating captive assets key to maximizing profit

The potential returns on investments like land and alternative fuel production, combined with additional on-farm storage facilities have elevated the concept of ‘opportunity cost’ to now rank among the most significant considerations. Hence, opportunistic producers are not only recalculating their profit equation but rethinking their entire asset deployment strategy in order to liberate and re-deploy capital for maximum leverage.

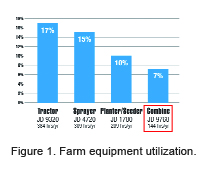

Recent data indicates that on average, agricultural equipment costs account for 42 percent of the non-land farming expense. When digging deeper, and comparing annual utilization, one of the most expensive items surfaces as the least utilized – the combine. The new Managed Lease Program from MachineryLink is a practical alternative for many growers, saving as much as 40 percent versus combine ownership. Teaming with Agri-Trend LLC has powered their market expansion across central and western Canada.

Leasing a combine from MachineryLink converts the traditional investment in an under-utilized, capital-intensive asset into a more efficient operating expense. The Managed Lease controls combine harvest expense for three years, and relieves the grower from the cost and time associated with annual maintenance and unexpected repair.

Outside of farming, few if any successful companies would invest $225,000 into a piece of capital

equipment that will only be used seven to 10 percent of the year.

Annual depreciation, insurance, maintenance, repair, and opportunity costs associated with combine ownership present a substantial burden to a grower’s ability to respond to fresh opportunities where cash is required. Leasing a late model combine with modern harvest technology provides an alternative.

Equipment asset management: one of four key profit levers

Equipment asset management: one of four key profit levers

Just as the laws of aggressive asset management have come to govern other industries, it is also becoming the prevailing wisdom in agriculture. Adding additional production and storage capacity, reducing risk, requiring improved equipment for more efficient operations and reducing debt are all key motivations for re-thinking the equipment equation.

Ag lenders, financial advisors, accountants and consultants agree that financial stability secured by ‘return on capital’ or ‘return on assets’ is the primary factor in measuring management effectiveness.

Moe Russell, president of Russell Consulting Group in Panora, Iowa, is an advocate of improving a farm’s balance sheet by reducing the impact of equipment costs. “We’ve identified four major leverage points that farmers concentrate on who are clearly above the average on return on assets. Equipment cost management is one of the four major points. The variance in our Russell Consulting Group database shows a $119 per acre variance from the most efficient to the least efficient producer,” according to Russell.

From a Canadian perspective, Terry Betker of MNP Consultants of Winnipeg, Manitoba, elaborates on the variation in fixed costs across the different regions and provinces. “Fixed (amortization, interest, payments) and operating costs for harvesting equipment depend a lot upon the size of the farm of course, the type of crops grown and even where the farm is. For example, you need more combine capacity the further east of Regina you go (higher yields, fewer days in the field because of higher ambient moisture) and less as you go west. You need less as you go south (lower yields but more days in the field) and more as you go north. You need more harvesting capacity in the Red River Valley in Manitoba than you do in the southwest corner. Same goes for the Peace River and southern Alberta areas. Meanwhile the Total Fixed Costs (TFC) are not affected by location, yields or crops to the same extent.”

How MachineryLink’s Managed Lease works for growers

Unlike a conventional dealer lease or rental program, the MachineryLink Managed Lease is tailored to the producer’s specific combine requirements and use period. Producers using the program have fractional use of late-model combines, delivered on-time for harvest, then the combines move to service areas where they are inspected, cleaned and made ready for delivery to another farm operation’s harvest, likely in a different region of the country.

As this new program is introduced to the Canadian market, MachineryLink uses a financial analysis tool to illustrate the comprehensive costs involved with combine ownership and their impact on a grower’s profit objectives. This comparison often results in an annual savings between $29,000 and $52,000 versus ownership. Improvements to operational productivity and reduced maintenance can also produce additional savings of $7000 to $ 18,000.

The following example illustrates the typical cost of owning a newer combine and running the separator 200 hours per year as being $140,000, when depreciation, financing, insurance, storage and repairs are taken into account for three years. Over that same three year period, a MachineryLink Managed Lease with a fixed cost, using the same 200 annual separator hours harvesting 2300 acres would produce a 27 percent savings. The cost of combine ownership extends well beyond the payments to the seller and can be eroding the operational profitability.

Tools to calculate your profit potential

Tools to calculate your profit potential

Understanding the true cost of equipment ownership must take into account both the cost of acquiring and operating the equipment. Before relying on an online or management software tool, the producer needs to be assured the calculator includes all the relevant costs, including actual opportunity cost, tax consequences, and uses net present cash value in computing those costs.

Reliable analysis must extend beyond conventional assumptions and incorporate current data on equipment prices, maintenance, insurance, storage and so on, not vague miscalculations that can result in faulty conclusions.

Potential issues such as loss of rented acreage, major repair expenses (including downtime), or crop loss can expose a grower to liabilities that exhaust his resources. MachineryLink’s Managed Lease includes provisions for crop loss, unused hours or other unforeseen consequences that

drastically reduce those liabilities. If a Managed Lease customer acquires more acreage, he has the option of up-sizing as well, capitalizing upon the flexibility of the contract.

There are a number of reliable tools available to assist producers and their advisors in calculating risk assessment and financial benefits. Ontario and Alberta agriculture departments are just two institutions that offer useful online calculators that enable the producer to input current data and illustrate the real cost of owning equipment and, inversely, see the dramatic dividends that can be realized from leasing alternatives. For more information visit: in Ontario, www.omafra.gov.on.ca; in Alberta, www.agric.gov.ab.ca, Additionally, Saskatchewan Agriculture and Food offers current benchmark costs for ownership and equipment rental plus easy-to-use downloadable worksheets to aid in preparing comparisons. For more information visit: in Saskatchewan, www.agr.gov.sk.ca/docs/management. MachineryLink regional sales manager, Eugene Toth in Lacombe, Alberta, uses a comprehensive computer program worksheet that analyzes multiple expense variables and calculates the impact to a grower’s bottom line. He can be reached at: (403) 782-6688, or e-mail to etoth@machinerylink.com