Features

Agronomy

Storage

Grain transport, storage and export issues

The global grain trade is changing, and everyone in the industry – including farmers – has to be ready.

November 30, 2011 By Treena Hein

The global grain trade is changing, and everyone in the industry – including farmers – has to be ready. “The marketplace will only become more complicated, and to take advantage of all market opportunities, we need the right infrastructure in place,” says Barry Senft, chief executive officer of the Grain Farmers of Ontario. “We need the flexibility and capacity to be able to move quickly when an order comes in.”

|

|

| On-farm storage units are increasingly popular, particularly as crop yields and commodity prices have increased.

|

Two of the major factors about to further complicate the grain trade are deregulation of wheat sales and Canada’s free trade agreement (FTA) with the European Union, both expected to take effect in 2012. Once the Canadian Wheat Board loses control of cash grain buying, more high-quality milling-grade Canadian wheat is expected to flow into the US. The European Union’s FTA will likely increase export demand for many types of grain.

To prepare for these and other changes, brokers such as Parrish & Heimbecker are increasing grain storage and handling capacity at ports. “Our belief is that commodities will move globally through the most cost-effective and energy-efficient mode,” says P&H spokesperson Steve Kell. “And in order to create access to the broader world market, the Ontario grain industry needs to be constantly improving transportation infrastructure.”

As the first phase of an expansion at the Port of Hamilton, P&H has constructed a new grain terminal that became operational in August 2011. It features two separated sections totalling 2.2 million bushels of storage. “The Hamilton location was selected due to its capacity to interchange between highway, railroad and marine transportation modes,” Kell notes. “The facility is designed to support high-speed loading and unloading of trucks and vessels.”

|

|

| According to OMAFRA’s Helmut Spieser, growers need to look beyond the initial construction of their on-farm storage units, to keep future needs and enhancements in mind. |

In addition to the changes at Hamilton’s port, P&H also has made significant improvements to the Owen Sound grain elevator in order to boost efficiency and enable that facility to handle a broader range of grain products. Kell notes that the less segregation capacity there is at terminal facilities, the more critical traffic management becomes. “Too little ability to segregate makes it difficult to execute business and too much capacity is wasteful,” he observes. “The challenge is for each terminal operator to find their own level of comfort with their market and its requirements.”

Richardson International Limited also has recently increased both its storage and truck-handling capacity at its Hamilton terminal. Further expansions on its vessel-loading system are also underway, says merchandising manager Gino Becerra. “The time frame for export out of Ontario is limited to the months the seaway is open,” he says. “And it is concentrated between October and December each year, so we need to be very efficient in handling an ever-growing harvest within a short period of time.”

Grain storage capacity at ports, Kell says, only needs to meet operational requirements for the loading and unloading of vessels. “With the increase in storage, drying and conditioning capacity at the farm level, the core function of port terminals is to provide fast and efficient transitioning of the grain from one mode of transportation to another,” he says. The Association of Canadian Port Authorities and Transport Canada are funding a joint study to assess the infrastructure needs of Canada’s 17 ports for handling all types of cargo during the next 15 years.

On-farm grain storage – the right way

Due to some excellent crop yields and high crop prices since 2008, many farmers in Ontario have taken the plunge and had their own grain storage systems installed, and many more are about to do the same. “I’ve talked to some of the companies that build systems and they’re booked into 2012,” says Helmut Spieser, field crop conditioning and environment engineer with the Ontario Ministry of Agriculture, Food and Rural Affairs (OMAFRA). “Many new systems are being built, or farmers are adding things like a larger, taller bin to existing systems.”

Having on-farm storage is all about farmers enabling their ability to maximize profits. “You don’t have to be tied to what you can get at harvest or the month after harvest,” notes Spieser, adding that that month of storage may be free at elevators.

The Grain Farmers of Ontario is pressing the provincial government for accelerated depreciation for on-farm grain storage systems and for the harmonized sales tax (HST) to be waived at time of sale, rather than at the end of the year, as is now the case with fertilizer and other items.

Farmers who are thinking about installing a storage system must keep in mind above all, that they are responsible for the quality, says Spieser. “It’s certainly not a matter of just loading it into the bin or silo and forgetting about it,” he stresses. “Especially in the spring when your attention is on the fields, you have to remember to routinely check your grain, aerate to keep it at ambient conditions, check moisture and insects – everything.”

In terms of planning a system, Spieser says the biggest mistake farmers make is putting the focus on only building what they need or what they can afford at that point in time. “You have to put thought into what ‘Phase 2’ would look like,” he asserts. “Whatever you put up, it will be added to, whether that’s eventually a leg elevator, a dump pit, weigh scales or what have you, even though you don’t foresee that these things will ever be needed. You will expand your system, so put Phase 2 and even Phase 3 on paper.”

As such, Spieser recommends that during initial system construction, farmers should try to envision what those subsequent phases will require. For instance, make accommodations for the additional wiring or spacing for those later modifications. The thought put in before the initial construction will save time and money after.

To avoid other mistakes, Spieser advises talking to as many people, and visiting as many storage systems, as possible. “Keep in mind that each system is unique, and yours will be different than theirs,” he says, “but be sure to ask people what they would have done differently. I’ve heard lots of useful comments like, ‘We should have designed it so that if someone is unloading, we can still use the weigh scale,’ and ‘I would have made more room for maintenance and repair.’ You are going to need to fix things.”

Spieser has heard farmers say they wish they had built the system away from their main farm. “If it’s at your home, people assume you’re always open,” he says, “and also, if you ever sell the home farm, potential buyers may not want a grain drying and storage system.”

Spieser advises spending at least six months on a plan. “Draw it out and see if you can move grain from anywhere to anywhere,” he says. “Go over it with contractors. It’s a foolish farmer who thinks his design is without flaw or need for improvement.”

OMAFRA offers workshops on on-farm grain storage systems several times a year; contact Helmut Spieser for dates and locations at 519-674-1618, or via e-mail at helmut.spieser@ontario.ca.

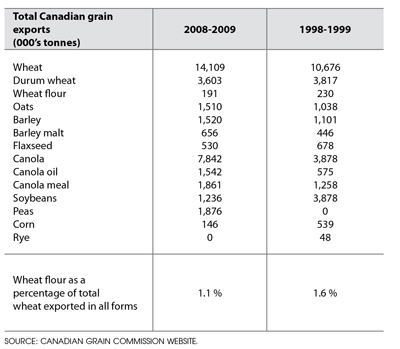

Total Canadian grain export trends over the past decade

|

During the 10 years between 1998-99 and 2008-08, export of all wheat has risen to 14,100,000 tonnes from 10,700,000 tonnes in 1998-99. Wheat flour exports have dropped a little (191,000 tonnes versus 230,000 tonnes 10 before then) while durum wheat exports are similar during the same time frame (roughly 3,700,000 tonnes). Oat exports have increased from 1,100,000 to 1,500,000 tonnes, and canola exports have doubled from 3,900,000 to 7,800,000 tonnes. Corn exports are down from 550,000 to 145,000 now.